For over three decades, unions fought tirelessly to secure the right to superannuation for all Australian workers, and in doing so, created Industry Super Funds to manage members’ retirement savings.

Today, Industry Super Funds cater to the needs of over five million Australian workers, a remarkable achievement that unions rightfully take pride in.

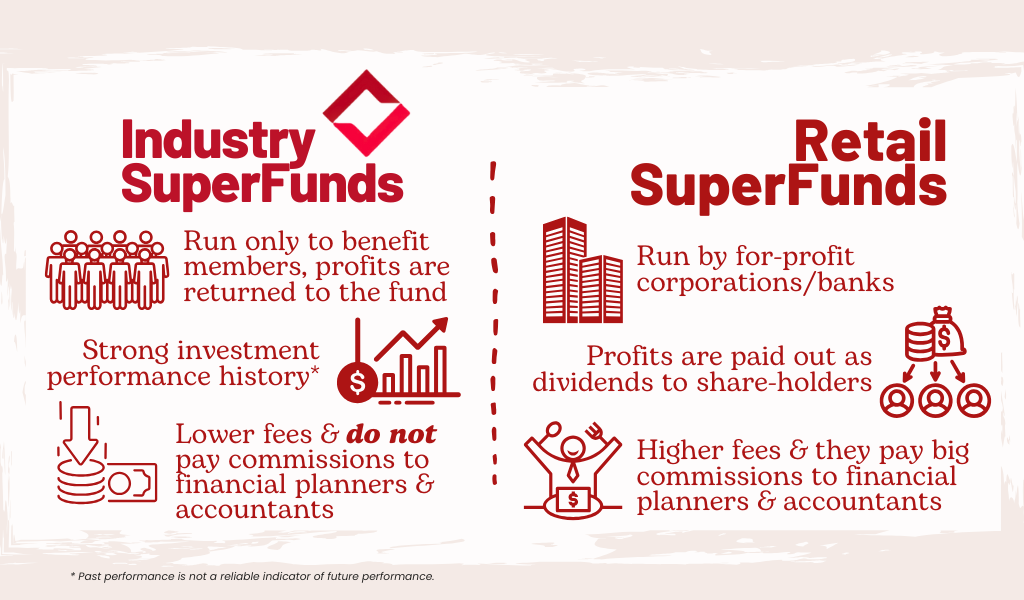

Superannuation funds can be broadly categorised into two types: profit-to-member funds (e.g., Industry Funds) and for-profit funds (e.g., retail funds operated by major commercial banks).

SA Unions unequivocally support Industry Super Funds and other profit-to-member funds, recognising their unparalleled track record of delivering higher investment returns to members while maintaining lower costs than for-profit funds.

Profit-to-member funds exist solely to benefit members, not shareholders, and were established by unions to give all workers access to superannuation. Trustee boards of these funds comprise an equal number of member-elected/union-elected representatives and employer representatives, ensuring that the interests of workers are safeguarded at all times.

On average, profit-to-member funds charge lower fees than retail funds, and do not pay commissions to financial planners and accountants. Moreover, they have a proven history of delivering strong long-term investment performance and prioritising innovative investment options that benefit members.

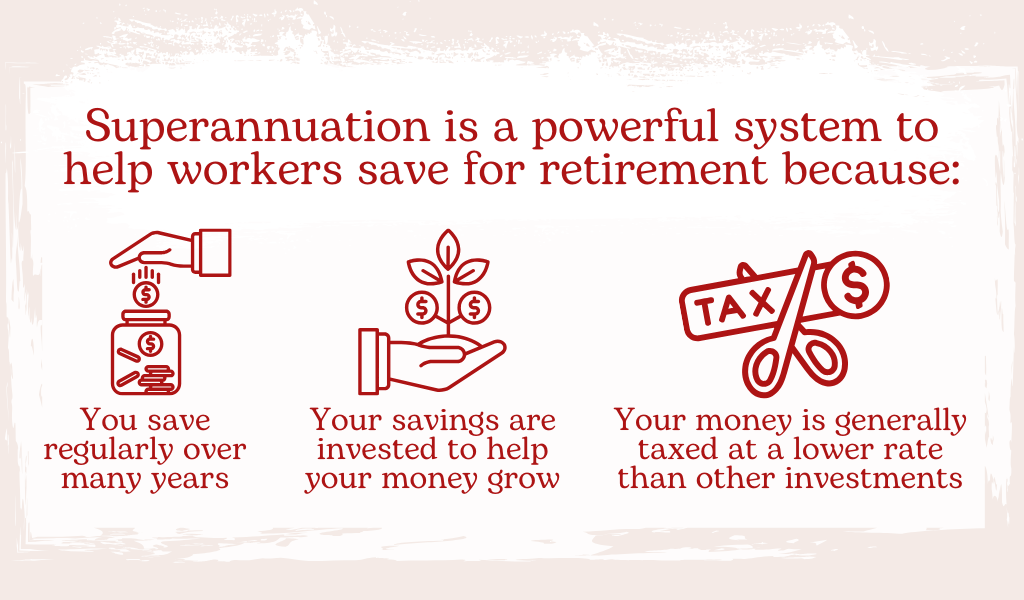

Superannuation is an investment vehicle designed to provide money for your retirement.

Industry funds focus on keeping fees and charges to a minimum and maximising your savings so you can do all the things you’ve dreamt of in your retirement.

Employer contributions

Your employer will pay superannuation contributions on your behalf unless you are exempt or self-employed. This contribution is called the superannuation guarantee. If you are eligible, your employer’s compulsory contributions must be equivalent to at least 11.5% of your earnings. For example, if you earn $60,000 a year, your employer will put at least $6,900 a year into your superannuation.

Personal contributions

You can also make personal contributions to your superannuation. If you make contributions from your after tax income, you may be eligible for the Government co-contribution.

Superannuation funds not only manage your super while you’re working, they can also help manage your money once you retire. Super funds have products that can provide you with a retirement income stream and keep your savings in a low-fee and tax-effective environment.

Transition to Retirement

Transition to retirement accounts may suit you if you are still working but want to reduce your work commitments while maintaining your income level.

Provided you comply with certain criteria, you may be able to convert your superannuation to a transition to retirement pension. This enables you to receive regular payments from your super savings to supplement your other income.

Account Based Pension

Account based pension accounts allow you to invest your superannuation benefits to create a regular ‘pay cheque’ paid weekly, fortnightly, monthly or even quarterly, half-yearly or annually.