If you’ve received a determination letter about your workers’ compensation claim, it’s important to understand what it means and how it affects you.

This guide explains the key points in plain language and highlights when you might need help from your union or the SA Unions Workers Compensation Service. All references to the law are from the Return to Work Act 2014 (SA).

Important dates

Determination Date: This is the date when the decision about your claim was made.

Receipt Date: This is the date you actually received the letter.

You have one month from the Receipt Date to challenge the decision in the South Australian Employment Tribunal (SAET). Sometimes, you can get more time, but this is not guaranteed, so it’s best not to rely on it.

Date of Injury: The correct date of your injury is crucial. An incorrect date could affect your entitlements, including income support payments or lump-sum compensation.

Check the injury description

The determination letter will describe your injury. If the insurer gets the description wrong, this may impact your treatment and recovery as well as any entitlement to future ‘lump-sum’ compensation.

It can be important to catch mistakes early.

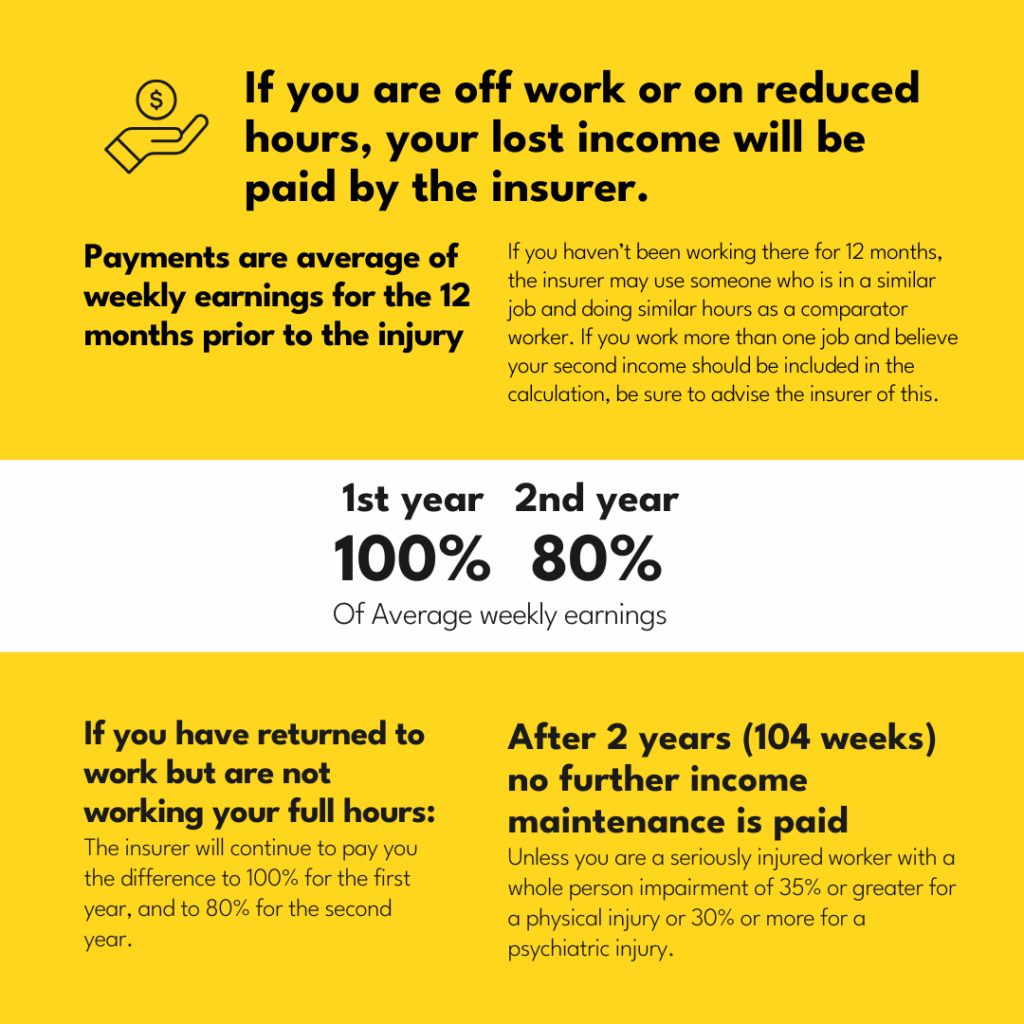

Income Maintenance

If your claim for income maintenance (weekly payments) is accepted, you’re entitled to:

First Year: You get weekly payments based on 100% of your Annual weekly earnings (AWE) and payment for necessary medical expenses.

Second Year: Weekly payments drop to 80% of your AWE, with medical expenses still covered.

Third Year: Only medical expenses are covered.

However, payments can stop earlier. If that happens, your medical expenses are only covered for one more year after weekly payments stop.

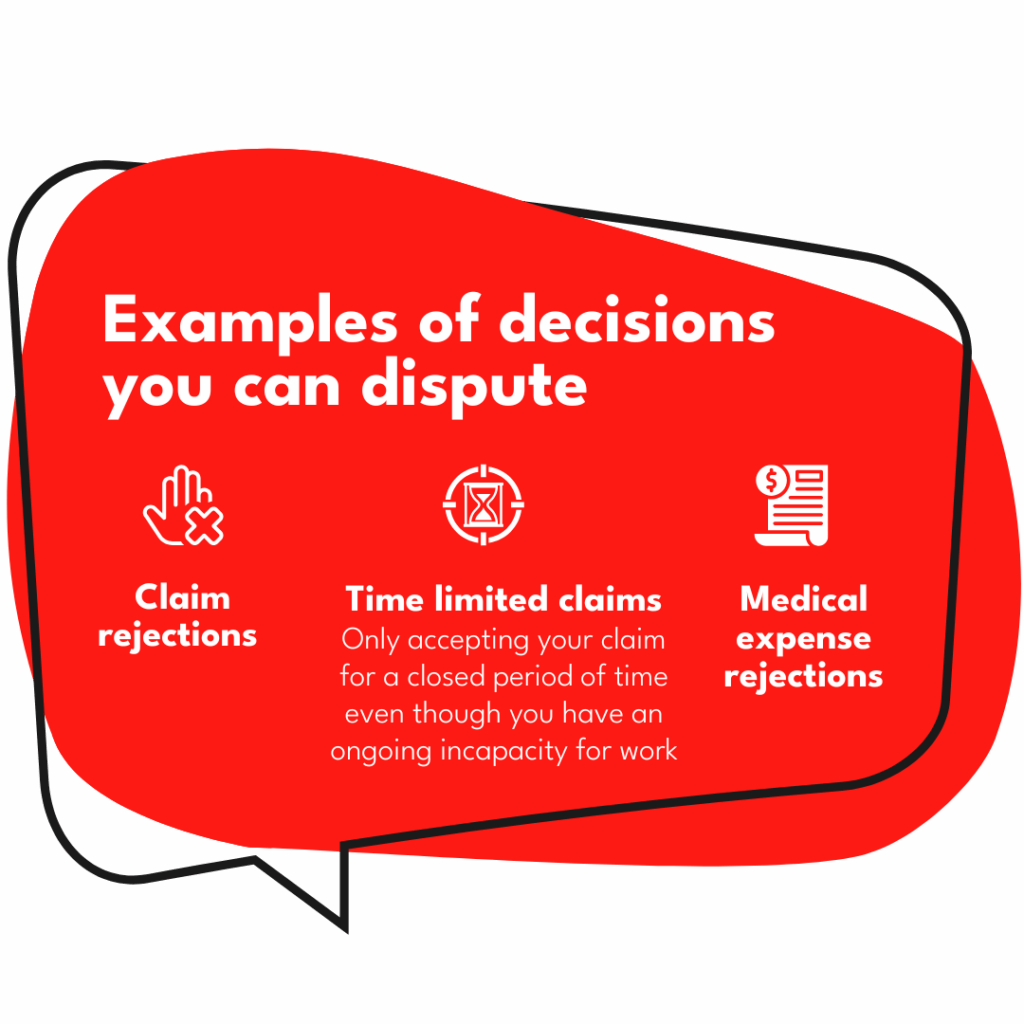

Sometimes, the insurer will only accept your claim for a fixed period, often until a doctor’s report says you can return to work. If you believe you still cannot work because of your injury, it’s a good idea to get a second opinion from another doctor. Your union or the SA Unions Workers’ Compensation Service can help you with this.

Average Weekly Earnings Rate (AWE)

The amount of the income maintenance payments is determined by calculating your average weekly earnings in that job for the twelve months prior to the injury. If you have not been working there for twelve months, the insurer may use someone who is in a similar job and doing similar hours as a comparator worker. If you work more than one job and believe your second income should be included in the calculation, be sure to advise the insurer of this.

Income maintenance is paid at 100% of your average weekly earnings* for up to 52 weeks (1 year) following the date of injury, and at 80% for the next 52 weeks. After 104 weeks, no further income maintenance is paid unless you are a seriously injured worker with a whole person impairment of 35% or greater for a physical injury or 30% or more for a psychiatric injury.

The AWE rate considers things like (but not limited to):

- Non-cash benefits (e.g., cars, phones),

- The national minimum wage, (see also)

- Any relevant awards or enterprise agreements.

- Whether the worker had a gradual onset injury, and this injury has had an unfair impact on their AWE rate

*Average Weekly Earnings are capped at 2x the State Average Weekly Earnings.

Rejected claims

If your claim is rejected, it’s often because the insurer claims that your injury is not work-related.

The standard of causation differs between the types of injuries, even though they must all “arise out of or in the course of employment”

Physical Injury: Your work must be a significant contributing cause.

Psychiatric Injury: Your work must be the most significant cause, and the injury cannot be due to certain work actions.

Insurers are required to advise the worker what information they have relied on in the determination of their claim.

Medical reports are provided along the way, but witness statements normally aren’t. It’s worth asking for the witness statements just in case you get a claim officer who doesn’t know not to provide them.