If your worker’s compensation claim is accepted, you may be entitled to income maintenance and/or payment of medical expenses.

Income maintenance covers your lost or reduced income if you have had to take time off or reduce your working hours due to your injury or illness. Medical expenses cover reasonable costs of treatment.

Income Maintenance

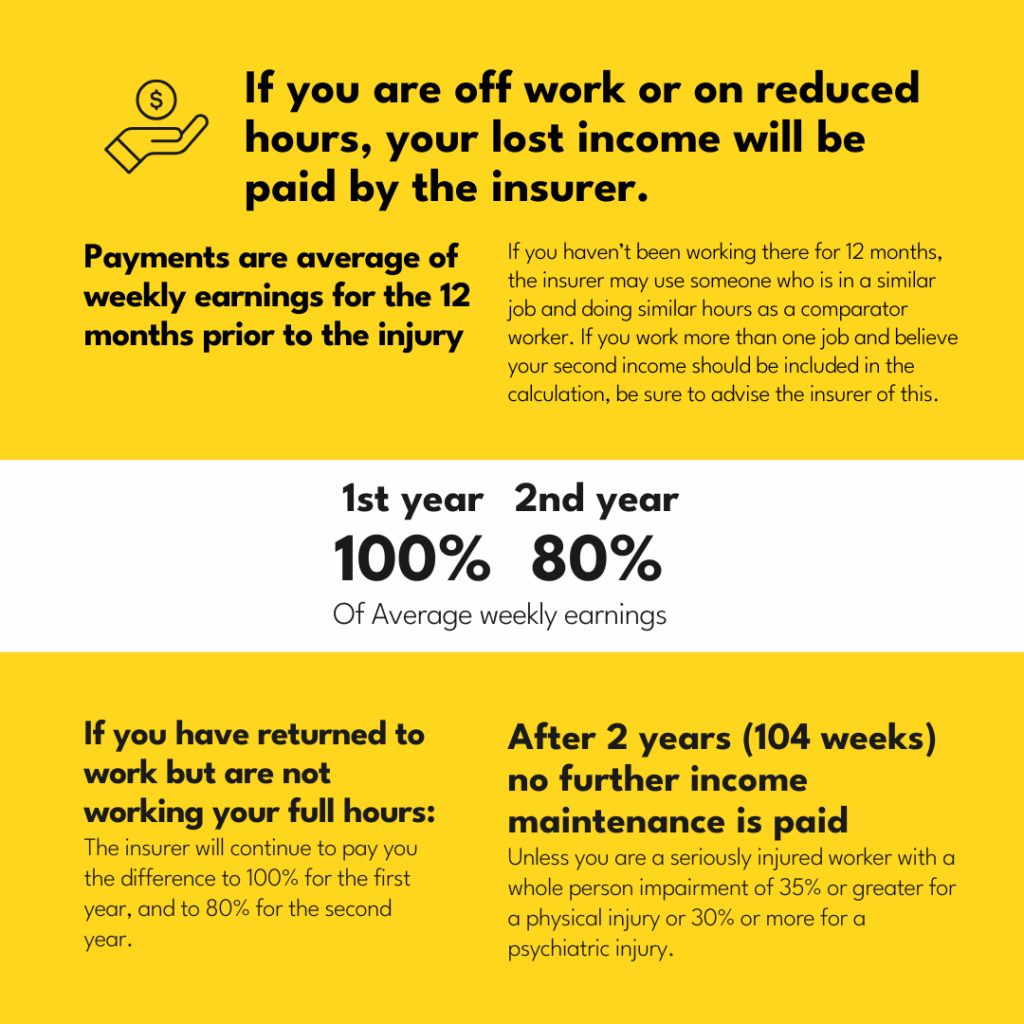

If your claim for income maintenance (weekly payments) is accepted, you’re entitled to:

First Year: You get weekly payments based on 100% of your Annual weekly earnings (AWE) and payment for necessary medical expenses.

Second Year: Weekly payments drop to 80% of your AWE, with medical expenses still covered.

Third Year: Only medical expenses are covered.

However, payments can stop earlier. If that happens, your medical expenses are only covered for one more year after weekly payments stop.

Sometimes, the insurer will only accept your claim for a fixed period, often until a doctor’s report says you can return to work. If you believe you still cannot work because of your injury, it’s a good idea to get a second opinion from another doctor. Your union or the SA Unions Workers’ Compensation Service can help you with this.

Average Weekly Earnings Rate (AWE)

The amount of the income maintenance payments is determined by calculating your average weekly earnings in that job for the twelve months prior to the injury. If you have not been working there for twelve months, the insurer may use someone who is in a similar job and doing similar hours as a comparator worker. If you work more than one job and believe your second income should be included in the calculation, be sure to advise the insurer of this.

Income maintenance is paid at 100% of your average weekly earnings* for up to 52 weeks (1 year) following the date of injury, and at 80% for the next 52 weeks. After 104 weeks, no further income maintenance is paid unless you are a seriously injured worker with a whole person impairment of 35% or greater for a physical injury or 30% or more for a psychiatric injury.

The AWE rate considers things like (but not limited to):

- Non-cash benefits (e.g., cars, phones),

- The national minimum wage, (see also)

- Any relevant awards or enterprise agreements.

- Whether the worker had a gradual onset injury, and this injury has had an unfair impact on their AWE rate

*Average Weekly Earnings are capped at 2x the State Average Weekly Earnings.

Medical expenses

Medical expenses are covered for 12 months after your entitlement to income maintenance ceases. So, if you are on income maintenance for the full two years, your medicals will continue for another year after that. If you are not entitled to any income maintenance, your medicals will be covered for 12 months after the date of injury.

Costs associated with getting treatment, including medications, travel costs, and accommodation (where applicable) are also covered by the insurer. Keep your receipts and a log of any treatment related travel.

If your medical practitioner expects that you will need surgery at a future date which is outside of the timeframe for your medical expenses to be covered, an application for future surgery can be lodged with the insurer. This application must be lodged during the period of medical expense coverage.

Surgery or treatment involving a therapeutic appliance, such as a prosthetic or implant, does not need to be applied for during the medical expenses period.

WPI – Whole Person Impairment

PIA – Permanent Impairment Assessment

After your injury has stabilised, or reached ‘Maximum Medical Improvement’ (MMI), you can be assessed to determine the percentage to which your injury has caused a whole person impairment. Contact the insurer and say you want to have a whole person impairment assessment to start this process.

You can choose who will perform the assessment from a list of accredited assessors. The assessor you choose needs to be accredited for the particular body part to be assessed, and cannot have been involved in your assessments or treatments prior to the PIA.

The assessment is undertaken in line with the American Medical Association’s Impairment Assessment Guidelines 5th

If you are assessed as 5% or greater whole person impaired for a physical injury, you may be entitled to a lump sum payment for economic loss and non-economic loss.

A payment for economic loss depends on factors such as when your injury occurred, your age, how many hours you work, and what the percentage of impairment is.

A payment for non-economic loss is based on the loss of function from your work injury to a particular body part, for example, loss of function to your lower back, wrist, etc.

Lump sums are not payable on psychological injury claims.

Lump sums for economic loss are not payable on noise induced hearing loss claims.

If you are assessed as more than 30% impaired for a psychological injury, or 35% for a physical injury, you are classified as a seriously injured worker and are entitled to ongoing income maintenance payments to retirement age and medical expenses until death.